The Recent Evolution of Shareholder Activism in the United States

The US shareholder activism environment is maturing and increasingly complex, characterized by new players, evolving tactics, and shifting boardroom dynamics. This report, a complement to The Conference Board annual Proxy Season Review, draws on data from SEC filings, investor websites, news releases, and media to highlight the growing use of board challenges, CEO targeting, and public campaigns to drive change.

Trusted Insights for What’s Ahead

- The volume of proxy contests at US public companies has doubled from last year, with a growing number of large firms being targeted—a sign that shareholder activism has evolved into a critical board-level risk. Directors should stay vigilant and prepared through proactive engagement, transparent disclosure, and robust readiness plans.

- Shareholder activism targeting CEOs has more than quadrupled since 2018, often leading to leadership changes and making rigorous performance reviews, transparent succession planning, and proactive board engagement essential. Our analysis suggests women CEOs may be disproportionately targeted by activists.

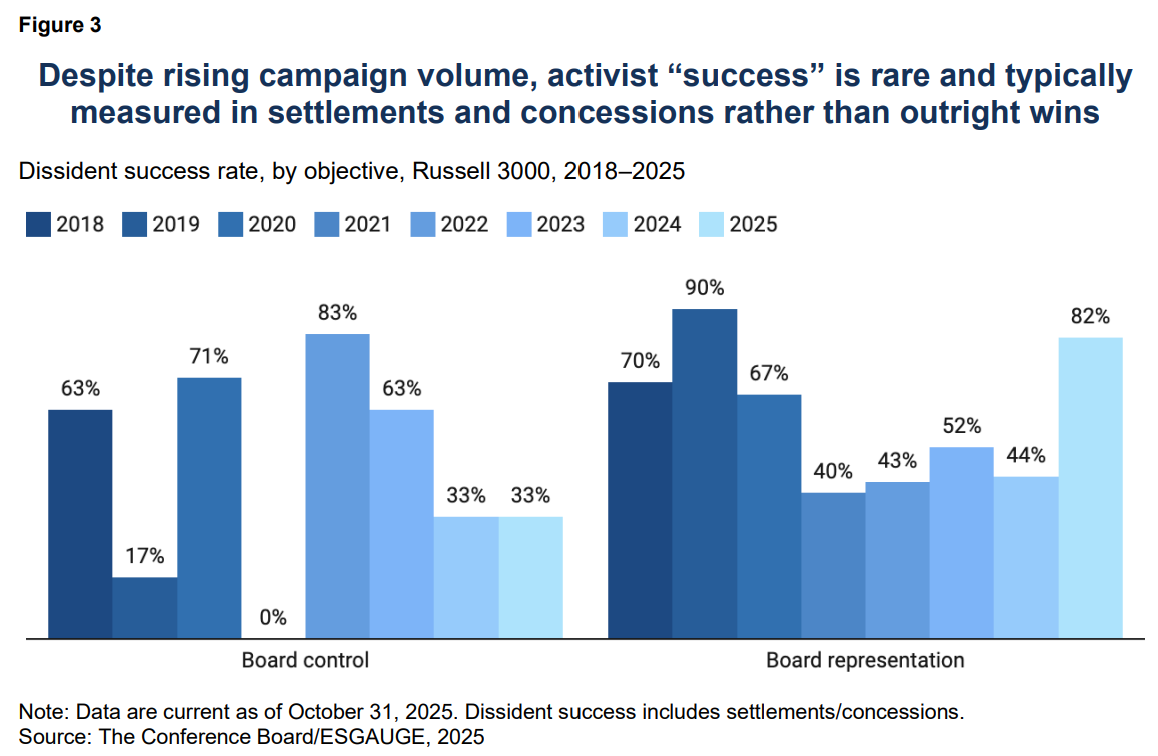

- Under universal proxy rules, activists have seen limited success as boards continue to prevail with institutional investor support, reinforcing the importance of strong engagement, transparent governance, and a compelling case for incumbent directors.

- Shareholder activism is increasingly undertaken through digital storytelling and multimedia outreach, so it behooves boards to use modern communications capabilities and rapid-response strategies to engage investors and counter activist narratives.

Proxy Contests

Proxy contests represent one of the most visible and contentious forms of shareholder activism. In such contests, dissident shareholders nominate one or more candidates to the board of directors and solicit proxy votes to replace incumbents. While proxy contests are relatively rare compared to other forms of activism, their visibility and potential for corporate disruption make them a critical area of concern for corporate boards.

2025 campaign volume and objectives

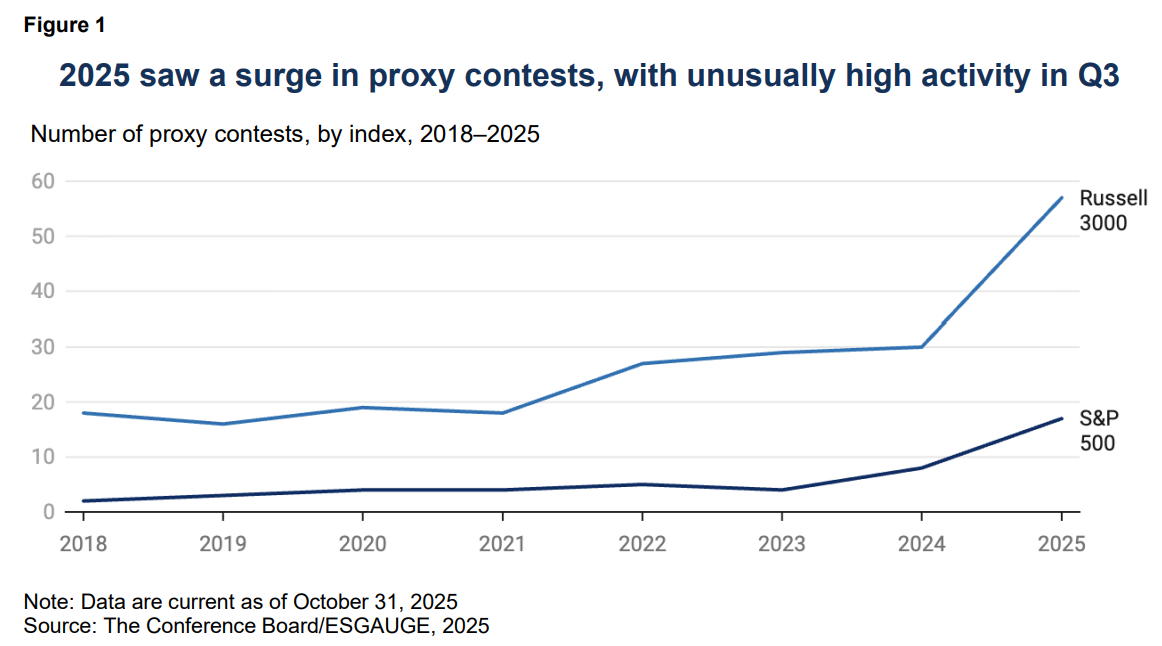

As of October 31, 2025, activist investors had launched 17 proxy contests against S&P 500 companies and 57 against Russell 3000 companies—the highest numbers recorded since 2018 and marking an unusually active third quarter of the year. Consumer discretionary (10 contests) and health care (12 contests) were the most heavily targeted sectors in 2025.

The most prolific filers of proxy fights consistently point to the perceived undervaluation of their target company, coupled with their belief that incumbent leadership is failing to maximize shareholder value.[1] For example, Starboard Value, filer of 16 proxy contests this year, says it targets “deeply undervalued companies” aiming to “unlock value.” Similarly, Carl Icahn often states that he focuses on companies with low valuation multiples, pushing for changes to enhance shareholder returns.[2]

Typically, filers expect to accomplish these changes through strategic and operational overhauls, M&A activity such as asset or company sales and, notably, leadership changes; indeed, a substantial number of their campaigns involve demands related to board composition—they seek either to be meaningfully represented on the board or to take full control of it.

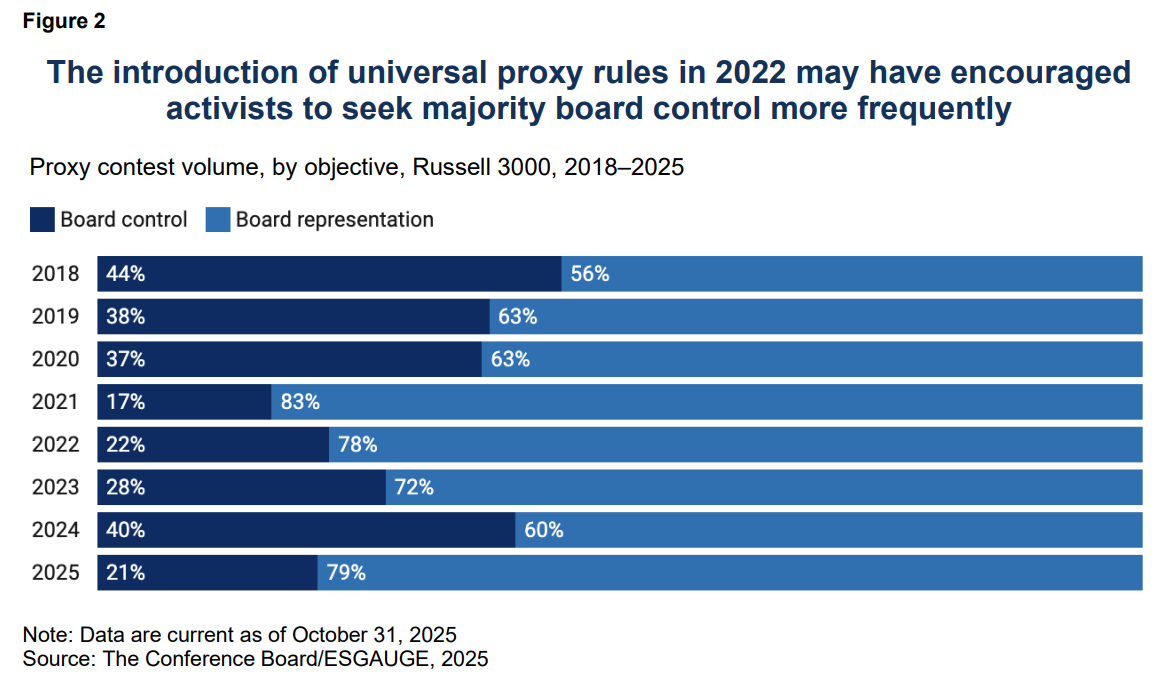

2018 saw a high percentage of proxy contests (44%) seeking to gain full board control rather than seats alone, but the percentage of such contests gradually shifted toward board representation only in the ensuing years until an apparent blip in 2024, when 40% of the 30 Russell 3000 contests sought majority control. In the first 10 months of 2025, the balance more typically seen in recent years has reasserted itself, with 21.1% of contests pursuing board control.

Activists may have been emboldened by the introduction of universal proxy rules from the US Securities and Exchange Commission (SEC), which went into effect in 2022 and fundamentally changed the mechanics of contested director elections.[3] The universal proxy card enables shareholders to vote for a mix of dissident and management nominees on a single ballot and should theoretically make it easier for activists to win more seats without launching a full control slate. In practice, however, activists have had limited success when the fight was pursued for full board control.

Vote outcomes and settlements

Despite the universal proxy rules, of the 57 proxy fight campaigns launched in the first 10 months of 2025, only eight proceeded to a vote, with companies prevailing in five of those contests. The other three produced partial wins for activists: Elliott Investment Management secured two of four board seats at oil refiner Phillips 66, falling short of a full overhaul despite proxy advisor support; Mantle Ridge captured three of four seats at industrial gases and chemicals company Air Products & Chemicals, unseating the lead director; and Bulldog Investors gained one seat at land developer Tejon Ranch. Notably, none of the voted contests in the first 10 months of 2025 resulted in an outright activist victory.[4]

All other cases in 2025 stopped short of a shareholder vote, with activists either withdrawing or securing concessions through settlements. A distinctive example was Ancora Holdings’ proxy fight to block US Steel’s sale to Nippon Steel and oust the CEO—ultimately abandoned after government intervention reshaped the deal, which closed in June under revised terms.[5] Other settlements included the Radoff–Torok Group gaining one board seat at energy services firm TETRA Technologies,[6] Starboard Value adding two directors at design software company Autodesk,[7] and Stadium Capital driving a major board refresh at Sleep Number, where five long-tenured directors, including the CEO/chair, agreed to step down.[8]

While the universal proxy card has removed some procedural barriers, winning board seats remains an uphill battle, particularly in large-cap companies with institutional ownership. Ultimately, the new rules have reinforced the importance of nominee selection and a robust defense strategy. As The Conference Board frequently notes in its Proxy Season Review reports, boards that maintain ongoing investor engagement and governance self-assessments may be better positioned to defuse these threats before they escalate.[9]

Exempt Solicitations and Vote-No Campaigns

Proxy solicitations are costly and subject to extensive rules that can be burdensome to investors wanting to communicate their views and recommendations on proxy matters to other shareholders. An exempt solicitation offers a simplified approach where investors are only required to file a notice of exempt solicitation informing the SEC of their intention to communicate with other owners without formally sending them proxy materials.

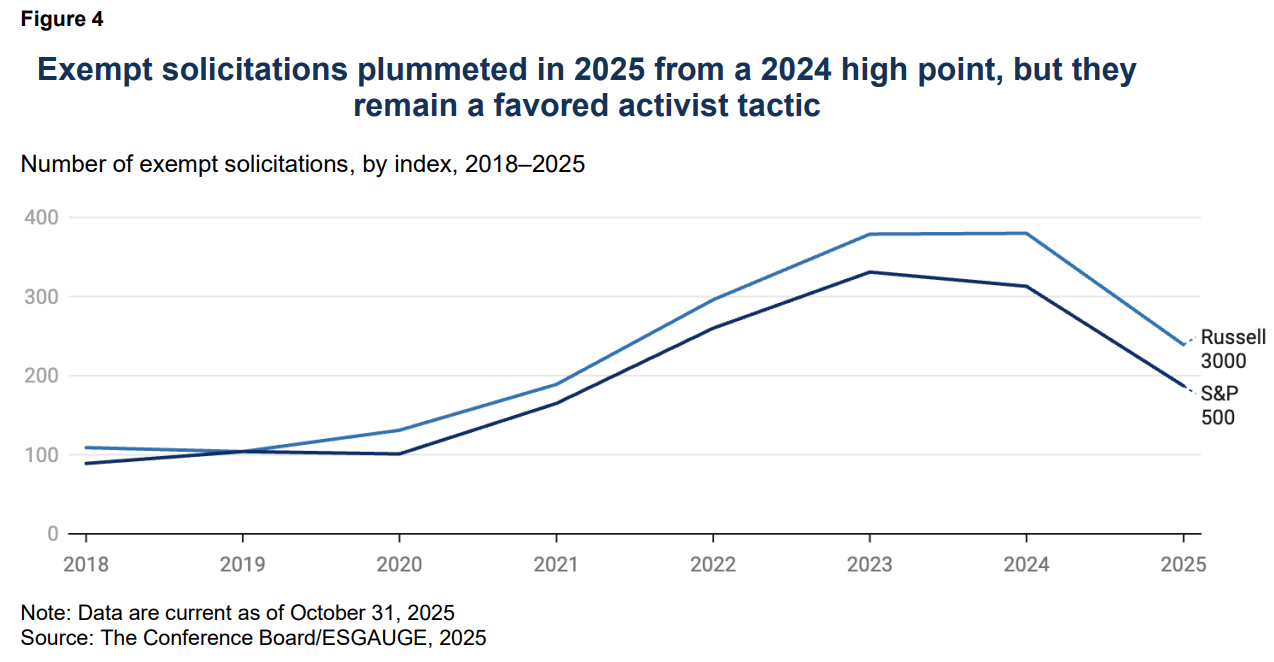

Volume

Exempt solicitations have surged in recent years as a favored tool for activists to express their opinions on contentious issues like director elections, shareholder proposals, proposed business transactions, capital allocation decisions, or other corporate matters. In 2018, The Conference Board and ESGAUGE recorded only 109 such filings across the entire Russell 3000 Index; by 2024, the volume had climbed to 380. Most exempt solicitations are used by investors of large-cap companies: in the S&P 500 alone (for the most part, a subset of the Russell 3000), shareholders filed 313 exempt solicitations in 2024, compared to 89 in 2018. (The probability of an S&P 500 firm being targeted by an activist investor, either through a proxy contest or an exempt solicitation, roughly tripled in the examined period, surging to more than 60%.) However, the volume of exempt solicitations at Russell 3000 firms fell in October 2025, likely reflecting the overall decline in shareholder activism and proposals this year.

Why did exempt solicitations decline in the 2025 proxy season?

After reaching record levels in 2024, exempt solicitation activity has moderated in 2025. Only 239 campaigns were recorded in the Russell 3000 as of October 31, suggesting that the surge observed in the prior years may have been followed by a natural period of adjustment. While part of this slowdown is likely cyclical, reflecting a normalization after an unusually active year, several broader factors may also be at play.

Market unpredictability: Heightened geopolitical tensions, volatility in energy and commodity markets, and a shifting global trade order have contributed to a climate of economic uncertainty, increasing the perceived execution risk for activist investors. In such an environment, some campaigns may have been postponed or restructured pending greater clarity in market and policy conditions.

Fewer ESG proposals: Another important factor behind the decline in exempt solicitations is the concurrent reduction in the number of shareholder proposals observed in the 2025 proxy season. Exempt solicitations often serve as tactical extensions of shareholder activism, leveraging the visibility and debate surrounding progressive shareholder resolutions—particularly those addressing environmental, social & governance (ESG) themes. When fewer such resolutions are filed or reach the ballot, there are correspondingly fewer opportunities and incentives for activists and other investors to mount exempt solicitation campaigns aimed at influencing the vote—whether in support of shareholder proposals or in opposition to management-sponsored items such as say-on-pay resolutions.

Regulatory changes: Regulatory developments may have had a moderating effect. Executive compensation continues to feature prominently in activists’ critiques of board oversight and alignment with shareholder value. The process initiated by the current SEC leadership to potentially revise compensation disclosure rules could be temporarily discouraging new activism centered on pay practices as investors await clearer guidance. Furthermore, in an October 2025 address at the University of Delaware, the SEC chair signaled that it may consider permitting companies, particularly those incorporated in Delaware and Texas, to exclude precatory (nonbinding) shareholder proposals under Rule 14a-8 when state law deems them an improper subject for shareholder action. If adopted, such an interpretation would represent one of the most consequential shifts in modern shareholder rights, substantially limiting a mechanism long used by investors to raise governance, social, and sustainability issues.

Vote-no campaigns

In a vote-no campaign, an activist shareholder files an exempt solicitation to urge fellow investors to vote against certain management proposals or directors (or withhold votes on those directors). Unlike proxy fights, vote-no campaigns do not seek to elect an activist’s nominees; rather, they aim to register shareholder discontent and pressure the board or management. When they occur, these campaigns are often coordinated with press releases, open letters, and social media to amplify their impact. By combining formal SEC filings (which business reporters can easily track on the SEC’s electronic data gathering, analysis, and retrieval [EDGAR] system) with broader communications, activists leverage vote-no campaigns to catalyze boardroom changes (such as the ouster of what they contend is an underperforming CEO or director) through the weight of negative votes and public pressure, even if no alternate director is standing for election.

Sector focus

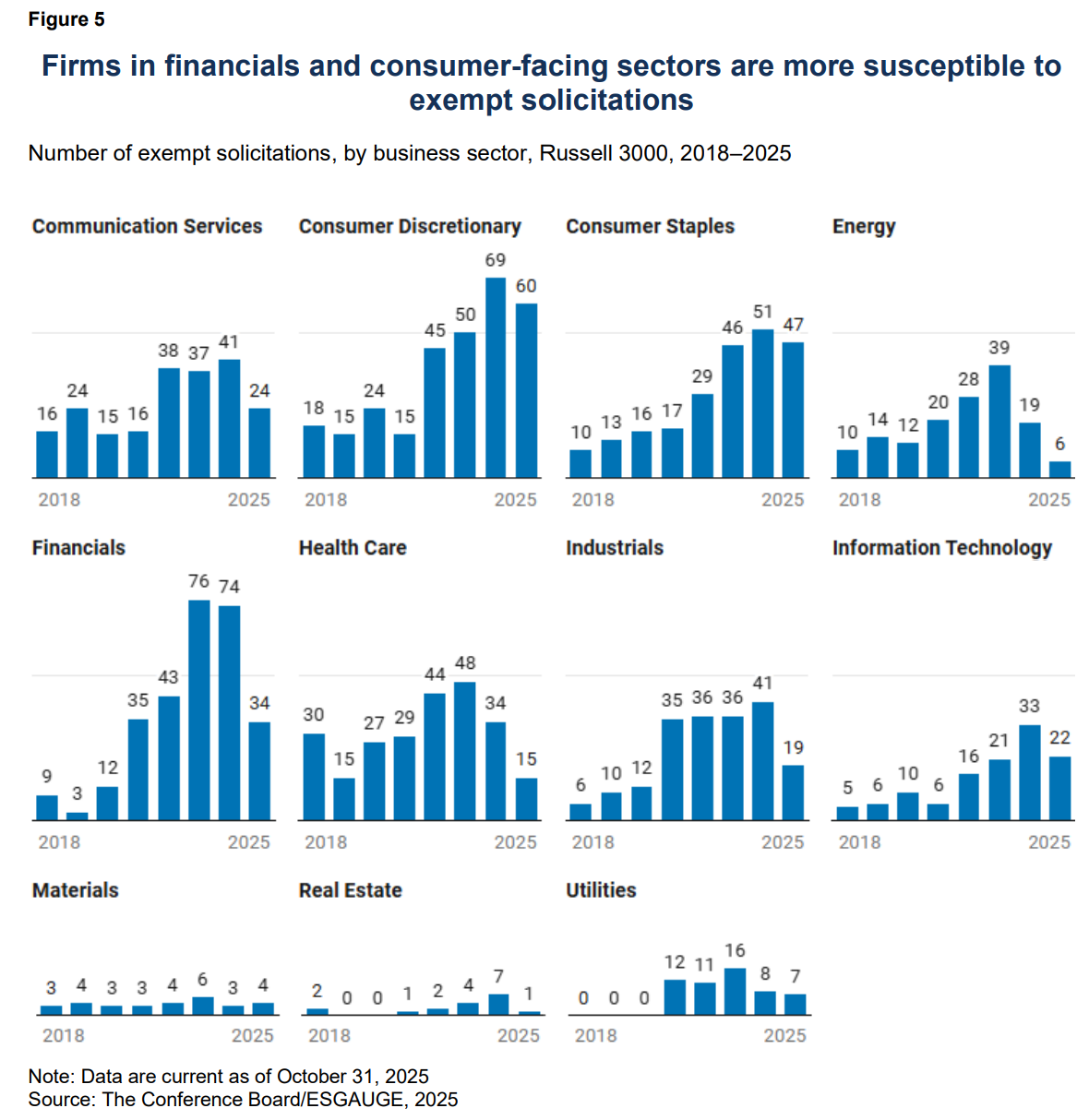

As with proxy contests, certain sectors have proven more prone to attracting exempt solicitation campaigns: consumer-facing and innovation-driven industries have seen particularly large spikes. For example, in the Russell 3000, exempt solicitations targeting consumer discretionary companies jumped from just 18 in 2018 to 69 in 2024 and 60 in the first 10 months of 2025. Similar upward trends played out in financials (from nine campaigns in 2018 to 74 in 2024 and 34 in 2025), consumer staples (10 to 51 and 47), and information technology (five to 33 and 22). By contrast, sectors such as materials, real estate, and utilities have remained relatively insulated, with consistently low campaign activity in those years. This suggests activists may be concentrating their efforts on industries where high profiles or governance concerns can more readily galvanize voting support.

Campaign objectives

The content of exempt solicitation campaigns also reveals their primary motives. An overwhelming majority of these filings are intended to support shareholder proposals: in the first 10 months of 2025, roughly 68% of exempt solicitations urged investors to vote for a shareholder-sponsored resolution (often on governance or sustainability topics), while 9% called to vote against a specific shareholder proposal—driven largely by arguments that ESG-related proposals were politically motivated, activist driven, and inconsistent with fiduciary duty. About 20% of campaigns pressed shareholders to vote against a management proposal (e.g., director election proposals, say-on-pay votes, or bylaw amendments that activists opposed), and only about 1% aimed to withhold votes from specific directors up for reelection. Only one exempt solicitation (submitted by Yunqi Capital at STAAR Surgical Company) was deployed in 2025 to rally opposition to a pending merger or acquisition, following two campaigns in 2024—an extraordinary step usually taken when activists believe a transaction is value destructive. These figures confirm that exempt solicitations are primarily a tool to drum up support for investor-sponsored initiatives or to register protest votes on management-driven ballot items.

Originally intended as a simplified means to communicate voting recommendations without triggering the full proxy solicitation rules, exempt solicitations have now become an influential platform for public advocacy. Activist investors have learned to leverage these filings—and the media visibility they receive thanks to the EDGAR system—as a megaphone to amplify criticism of company leadership and governance practices.

In many cases, the stated purpose of the exempt solicitation may be limited to supporting a specific shareholder proposal (for example, the separation of the CEO and board chair roles), yet the accompanying communications often go far beyond the formal issue at hand. These statements may include direct criticism of the board or the CEO, commentary on executive compensation, or even the activist’s broader vision for strategic change. By broadening the content of these communications, activists seek to attract media attention, shape the public narrative, and exert reputational pressure on the company, thereby increasing the leverage of what might otherwise appear to be a narrow governance proposal.

Digital broadcasting and other emerging solicitation tactics

In recent years, both activists and corporate boards have embraced digital storytelling to sway shareholders, blending traditional media with podcasts, videos, and social platforms to drive engagement and influence votes.

Hedge fund Elliott Management introduced a novel tactic during its high-stakes battle with Southwest Airlines in 2024. Recognizing the limitations of standard letters and slide decks, Elliott launched the dedicated podcast series Stronger Southwest. The series featured one-on-one interviews with Elliott’s director nominees, such as former WestJet CEO Gregg Saretsky, who discussed their qualifications and vision for the airline. This approach allowed Elliott to bypass traditional media and speak directly to shareholders, especially retail investors, detailing credentials and rationale for its campaign in an accessible, narrative-driven medium.[10]

In response to these developments, legal advisors are recommending that companies also “consider using a variety of creative tools to engage with their shareholders, including by well-executed use of videos or other media as well as use of endorsements by celebrity shareholders.”[11] Disney became a case in point when it employed creative multimedia to fend off activist pressure from Nelson Peltz’s Trian Partners in 2024. The company produced animated, character-driven videos to explain to retail investors why maintaining the current board was essential and instruct them on how to vote. These videos were hosted on a dedicated VoteDisney.com microsite (now retired) and widely shared across social and traditional media. Disney also secured George Lucas’s public endorsement of the board: “Creating magic is not for amateurs,” the film director said in a statement.[12] These examples illustrate a broader shift in proxy warfare: activism is no longer confined to boardroom meetings or glossy letters; it also unfolds in the digital arena.

Beyond the adoption of new media formats, activist investors have also developed increasingly sophisticated communication strategies designed to galvanize broader shareholder support. Whereas earlier activist campaigns often operated in isolation or within informal coalitions of hedge funds, today’s leading activists seek to engage larger institutional investors—including public pension funds and long-term asset managers—and to align their messaging with these investors’ governance and sustainability priorities. This evolution reflects both the institutionalization of activism as an asset class, with a demonstrable track record of investment returns, and the recognition that successful campaigns depend on mobilizing a wider base of shareholder backing.

In practice, these campaigns frequently weave governance and sustainability themes into arguments that otherwise center on corporate underperformance or strategic missteps. By framing their calls for change within narratives that emphasize board accountability, transparency, and long-term value creation, activists enhance the resonance of their message among institutional investors. As a result, modern proxy contests and exempt solicitations are as much about shaping the governance discourse as they are about immediate financial outcomes.

Activism Targeting CEOs

The number of shareholder activism campaigns explicitly targeting sitting CEOs has risen sharply since 2018, with a notable surge in the postpandemic years. (In this report, campaigns that explicitly target a CEO are identified based on unambiguous language in SEC filings or other formal campaign materials issued by the activist investor, including public letters and exempt solicitation notices attached as exhibits to investors’ Schedule 13D and Schedule 13G filings.)

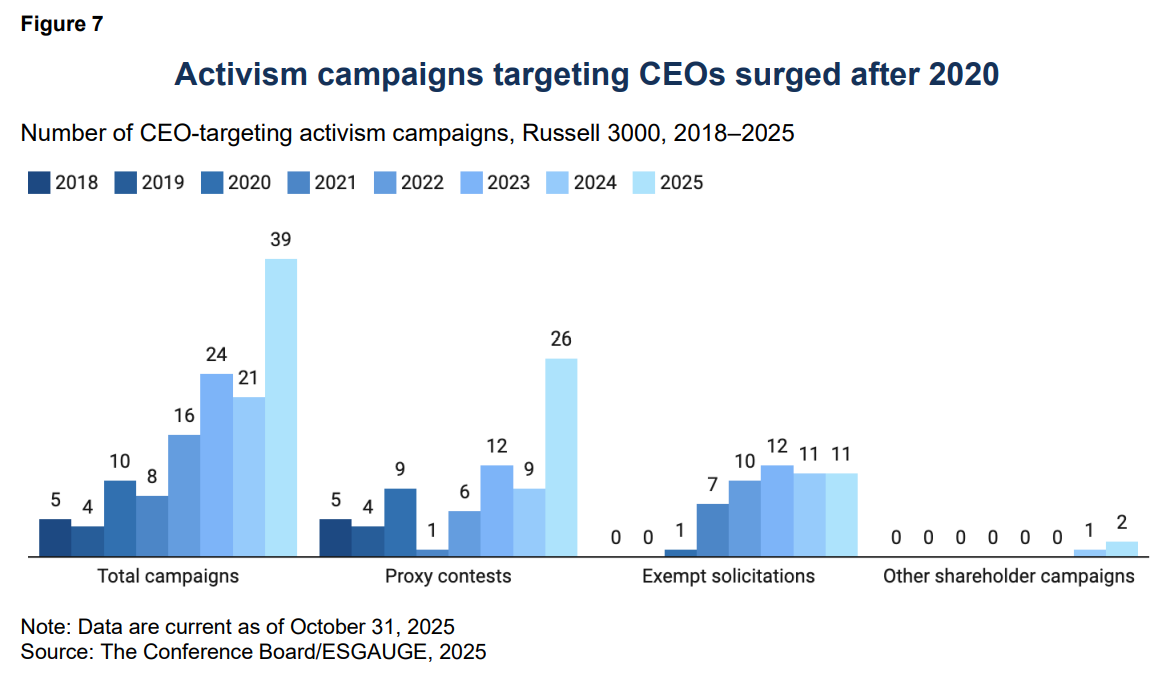

Between 2018 and 2025, shareholder activists launched 127 campaigns with the explicit goal of ousting or replacing the CEO, with 48 (37.8%) resulting in a CEO change. While only five campaigns were recorded in 2018 and four in 2019, the frequency began accelerating in the aftermath of COVID-19, reflecting growing investor impatience with leadership performance amid heightened volatility and stakeholder scrutiny. By 2022, there were 16 CEO-targeting campaigns, and that number rose to 24 campaigns in 2023 and 21 in 2024, more than quadrupling the prepandemic average. This trend continued into 2025, with a record 39 campaigns in the first 10 months of the year. This escalation signals a structural shift in shareholder expectations around accountability, with CEOs—rather than the board or the broader management team—increasingly viewed as directly responsible for strategic missteps, ESG controversies, or lagging financial performance.

Equally striking is the transformation in the form these campaigns have taken. In the earlier years (2018–2020), CEO-targeting efforts primarily materialized as full-fledged proxy fights in which dissidents nominated alternate directors and sought control or influence through contested votes. However, since 2021, a majority of these campaigns have begun to adopt a more tactical approach: exempt solicitations, where activists urge shareholders to vote against a management-backed proposal—typically the reelection of a key director or the CEO. These exempt communications, which avoid the cost and complexity of a proxy contest, have become the favored vehicle for signaling dissatisfaction with leadership while still mobilizing investor support.

Common issues in CEO-focused campaigns

In their filings, activists typically state that their reasons for targeting CEOs are situations of chronic underperformance, ill-fated acquisitions, stagnating share prices, or governance controversies. The focus on the CEO is often symbolic, and demands for leadership changes tend to be tied to broader campaigns for board representation or a redirection of the corporate strategy. For example, Icahn’s campaign at Occidental Petroleum (2019–2020) followed the company’s costly acquisition of Anadarko Petroleum without a shareholder vote.[13] Despite the pressure, CEO Vicki Hollub never resigned, but Occidental and Icahn announced a truce that brought back former CEO Stephen Chazen as chair and added three directors, including Icahn’s two representatives (Icahn exited his position in 2022).[14]

Similarly, Elliott Management’s campaign at Twitter in 2020 questioned the company’s governance structure and then-CEO Jack Dorsey’s leadership, particularly his dual roles as head of Twitter and Square. Though Dorsey survived the initial campaign through a negotiated settlement,[15] he resigned in late 2021, signaling Elliott’s lasting influence.[16] Other notable campaigns targeting CEOs include Southwest Gas (2021–2022), where Icahn again reacted to a controversial acquisition and demanded and obtained the replacement of then-CEO John Hester as well as the appointment of multiple board members,[17] and Disney (2023), where activist Nelson Peltz of Trian Partners criticized CEO Bob Chapek’s leadership amid content strategy shifts and stock underperformance. Chapek was later replaced by former chief Bob Iger, and the company avoided the proxy battle by addressing several of the fund’s concerns—cutting costs, revamping its streaming business, and reinstating its dividend, which it had suspended in the early days of the pandemic.[18]

In 2024, at Norfolk Southern, Ancora-led investors pushed against CEO Alan Shaw, citing poor governance and risk mismanagement (including the East Palestine, Ohio, train derailment in 2023). While ISS backed incumbents,[19] three activists were elected to the board.[20] Shaw remained initially but was dismissed in September amid misconduct allegations and replaced with CFO Mark George.[21] Also in 2024, at Southwest Airlines, Elliott Management elevated pressure on CEO Robert Jordan, alleging that the company’s leadership was too entrenched in the airline’s existing operating and pricing model to make changes to boost revenue.[22] “Southwest’s rigid commitment to a decades-old approach has inhibited its ability to compete in the modern airline industry,” the hedge fund said in a press release announcing its letter to the board.[23] The activist and the target ultimately reached a settlement in which Jordan was allowed to stay but the company agreed to replace six board seats (five of which were Elliott nominees, the highest number of seats ever obtained in an activist settlement in the United States).[24]

In early 2025, at Lamb Weston, hedge fund JANA Partners pressed for a full overhaul of the executive team, citing the systemic failures resulting from the company’s large performance gap compared to North American peers and the repeated cuts to earnings guidance. According to the fund’s statement, “by replacing the CEO with his ‘right hand’ COO, a 17-year veteran and long-time senior Lamb Weston executive, the Board demonstrated its continued failure to recognize the magnitude of changes required at the Company.”[25] In June 2025, an open letter to company shareholders reported the overwhelming support for a significant overhaul of the board of directors revealed by a third-party shareholder perception study commissioned by a JANA-led coalition of beneficial owners.[26]

Gender breakdown of targeted CEOs

Our research shows that female CEOs are disproportionately targeted by activist investors, which launched 2,053 campaigns against companies in the Russell 3000 Index in the 2018–2025 period. Of those, 152 (7.4%) were against companies with a female CEO (in one case, at Oracle in 2018, CEO Safra Catz was sharing the chief executive role with the late Mark Hurd). We also looked at campaigns where the activist filings explicitly criticized or targeted the CEO, and of the 127 we could record during this period, 20 (15.7%) explicitly targeted female CEOs.

Among others:

- At Occidental Petroleum, in 2020, Icahn Enterprises sought the ousting of CEO Vicki Hollub following a contentious acquisition.

- At Kohl’s Corporation, in 2022, activist fund Ancora Holdings asked for the replacement of then-CEO Michelle Gass with “new leadership with demonstrated experience in cost containment, margin expansion, product catalog optimization and, most importantly, turnarounds.” By the end of the year, Gass had stepped down.[27]

- At Duke Energy, in a 2021 campaign and then again in 2022, stakeholder group Majority Action filed notices of exempt solicitations to recommend that shareholders vote against the reelection of then-board chair, President and CEO Lynn J. Good for failing to “adequately adjust [the company’s] capital expenditures to align with its net-zero commitment.”[28] Good survived both vote-no campaigns.

- At Sleep Number, in 2024, activist investor Stadium Capital Management launched a campaign for board control lamenting the company’s strategic underperformance and advocating for new leadership. The campaign reprised an earlier attempt at obtaining board representation.[29] Under pressure, in October 2024, CEO Shelly Ibach announced her planned retirement and the company shared plans for additional board and governance changes.[30]

- At Victoria’s Secret, in 2025, Barington Capital explicitly targeted CEO Hillary Super in an activist campaign, with filings criticizing the company’s leadership strategy and operational decisions under her tenure. Super retained her position, and the company implemented selective operational changes but did not accede to the activist’s broader leadership demands.[31]

At Cracker Barrel Old Country Store, in 2025, activist investor Sardar Biglari, through Biglari Capital, launched a proxy campaign urging shareholders to vote against the reelection of CEO Julie Masino. The campaign cited underperformance, strategy missteps, and a contentious logo redesign that drew consumer criticism, and it included filings and public messaging calling for leadership change.[32]

To evaluate whether female CEOs are disproportionately targeted by activist investors, we adjusted for their structural underrepresentation in chief executive roles. In the examined 2018–2025 period, women accounted, on average, for only 6.3% of CEOs in the Russell 3000.[33] When comparing this figure to the proportion of activist campaigns that have targeted companies led by female CEOs—7.4% of all campaigns during the 2018–2025 period—it appears that women CEOs are actually targeted at a slightly higher rate than expected based on their rate of representation in the CEO population. Applying the same normalization method to campaigns explicitly targeting CEOs (where the activist filings or subsequent communications with the company directly criticized the chief executive), some 15.7% were directed at female CEOs—or two and a half times what would be expected based on their rate of representation in the CEO population.

A relative exposure ratio (RER), calculated as the percentage of campaigns involving female CEOs divided by their share in the CEO population, further confirms this pattern. For general activist campaigns, the female-CEO RER is approximately 1.18, and for explicit CEO-targeting campaigns it is about 2.50—both above 1.0. These figures suggest that female CEOs have been disproportionately exposed to activism during this period. While the relatively small sample size, particularly for explicit targeting, cautions against overinterpretation, the normalized data support the hypothesis of systemic activist overtargeting of female CEOs. (It is worth noting that an earlier academic study examining hedge fund activism from 2003 to 2018 also identified a statistically significant gender disparity: in that time period, activist hedge funds were found to be approximately 52% more likely to target firms led by female CEOs than those led by male CEOs, after controlling for firm characteristics.[34])

Several factors may help to explain these findings:

- Activists may subscribe to gender-role stereotypes that associate leadership traits with men. Because of an implicit bias (i.e., “think manager, think male”), women may be seen as less likely than men to succeed in senior management roles. If this hypothesis is true, women who reach the uppermost levels of organizational hierarchy will be subjected to greater scrutiny and criticism than men and encounter challenges and threats not faced by their male counterparts.[35]

- Women CEOs may often be set up for failure. According to the “glass cliff” hypothesis, women may be preferentially selected to lead problematic businesses, for which the risk of failure is higher.[36] In turn, such precarious conditions may attract activists, disproportionately affecting the few female-led firms.

- Activists may believe they will find it easier to exert their influence over female CEOs. This possible explanation rests on another stereotype—that women are generally more cooperative than men. Anticipating less resistance and a higher chance of settlement, activists may target female-led companies more readily, believing their pressure will have a higher probability of success.[37]

- Performance attribution biases may contribute as well. One study found that female CEOs face similar dismissal rates regardless of firm performance, whereas male CEOs are less likely to be ousted when results are strong. This suggests women leaders receive less credit for strong performance, leaving their firms vulnerable to activism.[38]

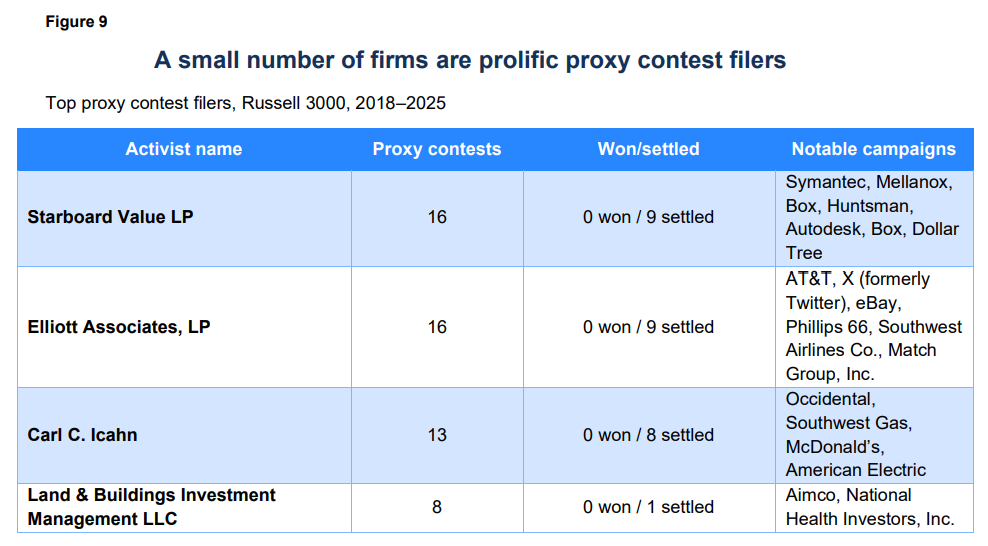

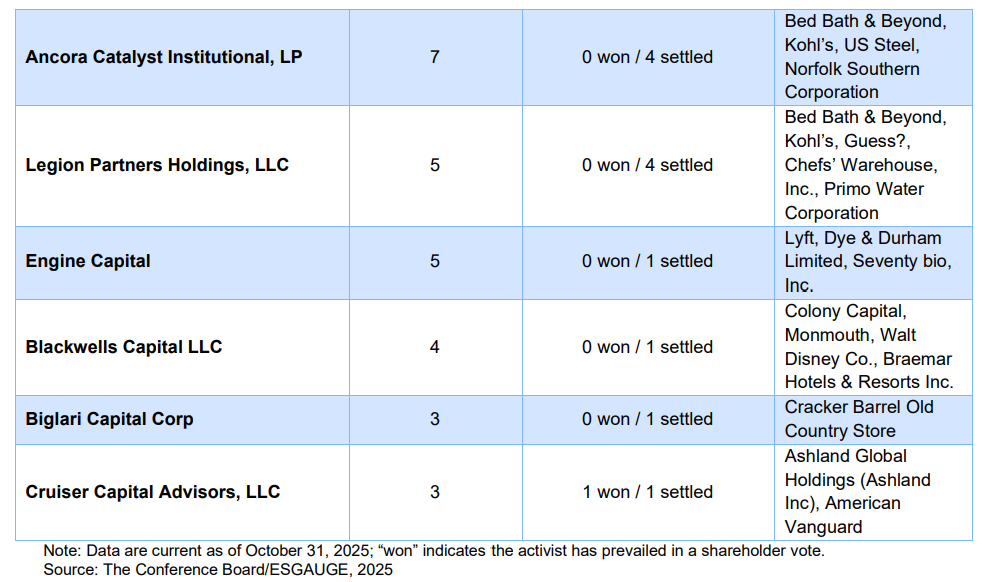

Top Activists

Hedge fund Starboard Value topped the list with 16 proxy fights, including successful campaigns at cybersecurity software developer Symantec[39] and networking service supplier Mellanox,[40] and high-profile losses at technology firm Box[41] and chemical company Huntsman (which made headlines in 2022 as the first proxy contest in several years where the company achieved a complete victory at the ballot box without ISS support).[42] Icahn waged 13 campaigns, securing board seats at Occidental in 2020 (a position he exited two years later, after the company issued stock warrants to its shareholders)[43] and Southwest Gas in 2022,[44] and even launching an animal welfare-driven (but unsuccessful) proxy fight at McDonald’s.[45]

Elliott Management (16 fights) used the threat of a proxy fight to 1) push telecommunications company AT&T to divest unperforming assets and conduct stock buybacks meant to raise its price and 2) to prompt leadership changes at Twitter (now X)[46] and eBay.[47] In 2025, Elliott secured two board seats at Phillips 66—the first time one of its US board election campaigns went all the way to a shareholder vote.[48] Land & Buildings made calls for sales or liquidations in the real estate investment trust (REIT) sector when it perceived significant net asset value discounts and governance issues, winning board seats at Aimco, among others.[49]

Acting as a “wolf pack,” Ancora Advisors (seven fights) and Legion Partners (five fights) collaborated on impactful board overhauls at embattled retailers Bed Bath & Beyond and Kohl’s, increasing director diversity.[50] Ancora is also known to critique M&A deals it deems unfavorable, such as its initial opposition to the US Steel/Nippon Steel transaction in 2025,[51] while Legion led a notable but unsuccessful ESG campaign at Guess?, opposing directors tied to harassment allegations.[52] Blackwells Capital (four fights) has pressured for a CEO change at Colony Capital[53] and blocked a merger at Monmouth,[54] both real estate investment companies. Among top activists, the only one to prevail in a proxy vote in 2025 was Cruiser Capital Advisors: American Vanguard shareholders voted to replace three directors with Cruiser Capital nominees.

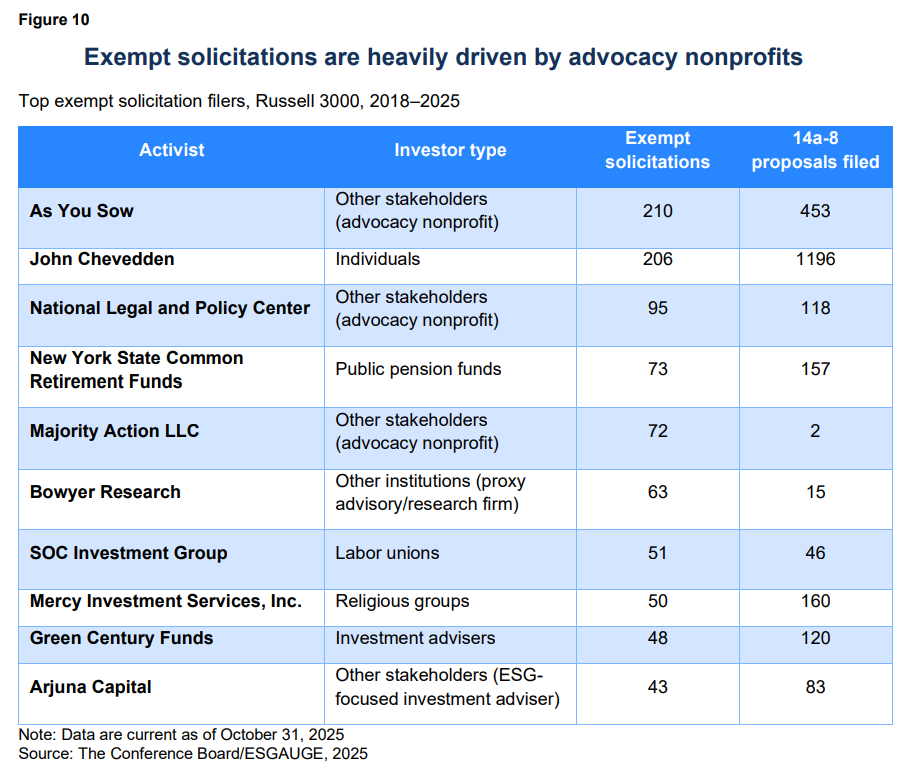

Figure 10 contains a list of the most active exempt solicitation filers over the past seven years. It shows the wide range of shareholder types involved in activism strategies, beyond the hedge fund category: public and private pension funds, index fund management companies, individual investors, and even the investment vehicles of religious groups or other nonprofit organizations. Unlike activist hedge funds, these investors are rarely motivated by short-term, speculative objectives; instead, they tend to pursue a variety of corporate social and environmental reforms. In some cases, especially in recent years, their agenda has been manifestly political.

Activist shareholder advocacy group As You Sow tops the list with 210 exempt solicitation filings in the 2018–2025 period, driving shareholder campaigns on a wide range of environmental and social issues. The nonprofit is known for prolific proposal submissions that push companies to address climate change, sustainable packaging, racial justice, and other ESG topics; its exempt solicitations are meant to galvanize other shareholders around its proposals, and many of its efforts have led to negotiated agreements with companies (and the withdrawal of the corresponding proposals). For instance, in 2022, As You Sow withdrew shareholder resolutions at consumer brands Kraft Heinz and Church & Dwight after those companies agreed to reduce the use of virgin plastic in their packaging.[55]

Individual investor John Chevedden is a close second with 206 filings in the 2018–2025 period, continuing his decadeslong crusade for corporate governance reforms. Often dubbed a “corporate gadfly,” Chevedden regularly submits proposals to bolster shareholder rights—such as lowering the threshold to call special shareholder meetings, allowing action by written consent, or requiring independent board chairs—and he frequently achieves significant support for these governance changes despite his small personal stake. (Chevedden has personally filed over 1,000 shareholder proposals over his career, making him one of the most persistent individual activists in US markets.)[56]

The nonprofit National Legal and Policy Center (NLPC) (95 filings) ranks next. NLPC and proxy advisory firm Bowyer Research share a conservative agenda and have been driving forces in the recent wave of anti-ESG shareholder activism, often using exempt solicitation filings to challenge what they view as “politically correct” or “woke” policies embraced by management. For example, NLPC has repeatedly sponsored proposals urging transparency around corporate charitable contributions and political activities—a campaign that has significantly increased the number of such proposals in recent years. NLPC’s exempt solicitation memos frequently exhort shareholders to support its initiatives (such as reports on charitable giving or lobbying) or to oppose management on hot-button social issues (one 2024 filing by NLPC urged Starbucks shareholders to reconsider the company’s “political activism” in its policies).[57]

At 63 filings, Bowyer Research, led by commentator Gerald “Jerry” Bowyer, is a relatively new entrant that has quickly made a reputation for its opposition of progressive shareholder proposals. For instance, Bowyer has campaigned against proposals to expand shareholder rights or to enhance diversity, equity & inclusion initiatives—in one 2025 case, it filed a statement recommending a vote against a shareholder proposal to lower the threshold for calling special shareholder meetings at US Foods.[58] Bowyer Research has also partnered with other conservative organizations such as Alliance Defending Freedom and the National Center for Public Policy Research to criticize companies’ diversity programs, arguing that these policies create legal and reputational risks for the companies that adopt them.[59]

On the progressive side of the political spectrum, nonprofit shareholder advocacy organization Majority Action LLC (72 filings) spearheaded several high-profile vote-no campaigns focused on board accountability, particularly around climate change. In 2022 alone, Majority Action targeted 25 companies—the most in its history—by filing exempt solicitations urging investors to withhold votes from certain directors.[60] These campaigns aimed to hold boards responsible for inadequate climate risk management or other governance failures. For example, Majority Action filed an exempt solicitation in 2022 encouraging Chevron’s shareholders to vote against the reelection of CEO Michael Wirth (also board chair) and lead director Ronald Sugar, citing Chevron’s failure to set adequate net-zero emissions targets and misalignment of its lobbying with the Paris climate goals.[61]

The New York State Common Retirement Fund (73 filings), overseen by New York’s comptroller, is the leading public pension fund involved in shareholder activism and takes a decidedly pro-ESG stance. The fund has leveraged exempt solicitations to press companies on climate action and governance improvements, aligning with its fiduciary view that sustainability issues are financially material. Notably, the comptroller’s office has used these filings to urge support for climate-related shareholder proposals at major banks and energy companies (for instance, calling on investors to vote for resolutions at big banks to phase out financing of new fossil fuel projects in line with Paris Agreement goals).[62] Through such campaigns, New York’s pension fund has pushed several companies to set emissions targets, enhance board diversity, and strengthen oversight of ESG risks; in April 2025, despite the intensified ESG backlash of the prior months, it committed additional resources to its Sustainable Investment Program.[63]

The top activist list includes a prominent religious group and a labor union. Mercy Investment Services (50 filings) is a faith-based investment arm of the Sisters of Mercy that has demanded corporate reforms related to social and ethical issues. Mercy frequently co-files shareholder proposals through coalitions of religious investors (under the Interfaith Center on Corporate Responsibility) and uses exempt solicitation statements to rally broader shareholder support. Its campaigns have addressed topics like human rights in supply chains, pharmaceutical pricing ethics, and climate change mitigation. For example, Mercy has filed exempt solicitation letters urging investors to back proposals for improved board oversight of workplace sexual harassment and climate risk management.[64]

SOC Investment Group, formerly known as CtW Investment Group (51 filings), is a coalition of North American labor unions’ pension funds. SOC says its focus is on holding corporate leaders accountable for fair labor practices, responsible executive pay, and ethical corporate behavior. It has targeted companies facing scandals or governance breakdowns—for example, urging shareholders of video game maker Activision Blizzard to vote against the reelection of six directors in 2022 in response to the company’s workplace sexual harassment and misconduct crisis.[65]

Finally, Green Century Funds (48 filings) and Arjuna Capital (43 filings) round out the top exempt solicitation filers: both are mission-driven investment firms focusing on sustainability and corporate responsibility themes. Green Century, an environmentally oriented fund, frequently sponsors shareholder proposals on climate change, deforestation, and other ecological risks, and it uses exempt solicitations to bolster these initiatives. Notably, a trailblazing Green Century proposal at Costco won nearly 70% support in 2022, compelling the company to set science-based targets to reduce its greenhouse gas emissions across its value chain.[66] Green Century has also pushed companies like Tyson Foods to address deforestation in supply chains[67] and is leading a campaign to persuade businesses to address plastic pollution (recently, it reached an agreement with Starbucks to ensure it provides accurate information about the recyclability of its plastic cups and shares details about its transition to reusable cups by early 2026.)[68] Arjuna Capital, a social impact investment firm, gained renown for its campaigns on gender and racial pay equity. Over the past several years, Arjuna’s shareholder proposals have successfully secured commitments from tens of companies to publish detailed gender pay gap data. [69]

Conclusion

Shareholder activism in the United States has entered a new era—one marked by expanded participation, more aggressive tactics, and greater visibility. As proxy contests increasingly pursue full board control and exempt solicitations surge across all sectors, activist investors are no longer relying solely on behind-the-scenes influence. They are publicly challenging corporate leadership, embracing digital media to mobilize support, and elevating CEO accountability as a core campaign objective. These developments reflect not only a maturing activism landscape but also a more demanding investor base that expects responsiveness, transparency, and performance from corporate boards and executives alike. For public companies, this evolving environment demands vigilance and preparation. Boards must proactively engage with shareholders, regularly assess governance practices, and stay attuned to the concerns that may trigger activist scrutiny. As the line blurs between financial underperformance and governance- and sustainability-related discontent, successful defense strategies will require a comprehensive understanding of both market expectations and stakeholder priorities.

This article is based on corporate disclosure data from The Conference Board Benchmarking platform, powered by ESGAUGE.

1 Matteo Tonello and Damien J. Park, The Shareholder Activism Report: Best Practices and Engagement Tools, The Conference Board, March 2010: 24. (go back)

2 Rebecca Ungarino, Casey Sullivan, and Daniel Geiger, Everyone Wants to Be an Activist Investor These Days. Insiders Like Carl Icahn Lay Out Why It’s Not as Easy as It Looks, Business Insider, December 15, 2022; Steven Bertoni, Inside Carl Icahn’s Brain: How He Picks a Target and Pull the Trigger, Forbes, March 11, 2011. (go back)

3 For a discussion of the impact of universal proxy rules: How Three Years of the Universal Proxy Card Rules Have Changed Proxy Contests, Sidley Austin LLP, September 9, 2025; 2024 Proxy Season Preview, Governance Watch webcast, The Conference Board, February 15, 2024. (go back)

4 AREX Capital Announced Director Appointment to Enhabit Board, AREX Capital Management LP, press release, July 29, 2024. (go back)

5 Ancora Announces Suspension of Campaign Following President Trump’s Initiation of New CFIUS Review of US Steel’s Sale to Nippon Steel, Business Wire, April 9, 2025. (go back)

6 TETRA Technologies, Inc. announces withdrawal of investor group nominees, PR Newswire, April 3, 2025. (go back)

7 Svea Herbst-Bayliss, Autodesk settles fight with Starboard, adds two to board, Reuters, April 24, 2025. (go back)

8 Stadium Capital Reaches Agreement with Sleep Number to Reconstitute Board, Olshan, March 20, 2025. (go back)

9 Merel Spierings, 2024 Proxy Season Review: 2024 Proxy Season Review: Corporate Resilience in a Polarized Landscape, The Conference Board, September 2024: 20. (go back)

10 Elliott Launches “Stronger Southwest” Podcast Featuring 1:1 Conversations with Its World-Class Director Nominees, PR Newswire, October 15, 2024; Alexandra Tremayne-Pengelly, Hedge Funds’ New Approach to Shareholder Activism: Podcasting, Observer, October 17, 2024; Shubhangi Goel, Why a Hedge Fund Made a Podcast About a Shake-Up It’s Pushing for at Southwest Airlines, Business Insider, October 21, 2024. (go back)

11 See, for example, Andrew J. Noreuil, Camila Panama, and Alexander J. Dussault, Disney’s Victory in 2024 Proxy Contest: Lessons for Boards and Practitioners, Mayer Brown, June 24, 2024. (go back)

12 Alex Weprin, George Lucas Backs Disney and Bob Iger in Proxy Fight: “Creating Magic Is Not for Amateurs,” Hollywood Reporter, March 19, 2024. (go back)

13 Carl Icahn, Open Letter to Occidental Petroleum Stockholders, CarlIcahn.com, February 12, 2020. Icahn asserts that CEO Vicky Hollub and the board bought Anadarko to save their own jobs and failed to protect shareholders’ capital when they heavily indebted Occidental by borrowing over $40 billion to purchase Anadarko “at a massive 65% premium.” (go back)

14 Cara Lombardo, Carl Icahn Exits Occidental Petroleum After Nearly Three Years, Wall Street Journal, March 6, 2022. (go back)

15 Kate Conger and Michael J. de la Merced, Twitter Reaches Deal with Activist Fund that Wanted Jack Dorsey Out, New York Times, March 9, 2020. (go back)

16 Dan Primack, Dorsey Departure Another Win for Elliott Management, Axios, November 30, 2021. (go back)

17 Svea Herbst-Bayliss, Southwest Gas Settles Boardroom Battle with Icahn, Replaces CEO, Reuters, May 9, 2022. (go back)

18 Brooks Barnes and Lauren Hirsch, Activist Disney Investor Ends Battle for Board Seat, New York Times, February 9, 2023. (go back)

19 Rohan Goswami, ISS Endorses Most of Activist Ancora’s Nominees for Norfolk Southern Board, CNBC.com, April 30, 2024. (go back)

20 Peter Eavis, Norfolk Southern Investors Reject Plan to Oust Its Management, New York Times, May 9, 2024. (go back)

21 Peter Eavis and Danielle Kaye, Norfolk Southern Fires C.E.O. After Ethics Investigation, New York Times, September 11, 2024. (go back)

22 Lila MacLellan, The Rapid Descent of Southwest Airlines: How the Company Plunged from Customer Cult-Favorite to Activist Investor Target, Fortune, October 26, 2024. (go back)

23 Elliott Sends Letter and Presentation to the Board of Southwest Airlines, PR Newswire, June 10, 2024. (go back)

24 Rajesh Kumar Singh, Svea Herbst-Bayliss, and Shivansh Tiwary, Southwest Airlines Settles Boardroom Feud with Activist Investor Elliott, Reuters, October 25, 2024. (go back)

25 JANA Partners Sends Letter to Lamb Weston Board of Directors, Business Wire, January 27, 2025. (go back)

26 JANA Partners Sends Open Letter to Shareholders Reporting Overwhelming Support for Significant Board Change at Lamb Weston, Business Wire, June 3, 2025. (go back)

27 Kohl’s Announces CEO Transition Process, press release, November 8, 2022. (go back)

28 Notice of Exempt Solicitation, Majority Action LLC, April 1, 2021. (go back)

29 Patrick Kennedy, Sleep Number Shareholder Issues Wake-Up Call to Company’s Board of Directors, Minnesota Star Tribune, September 13, 2023. (go back)

30 Sleep Number Chair, President and CEO Shelly Ibach Announces Retirement, press release, October 30, 2024. (go back)

31 Lila MacLellan, Victoria’s Secret Hired a Superstar CEO to Turn Around the Flagging Brand. But a 50% Stock Drop Has Activist Investors Circling, Fortune, June 28, 2025. (go back)

32 Daniella Genovese, Steak ‘n Shake owner’s fight to remove Cracker Barrel CEO just intensified, Fox Business, September 2025 (go back)

33 See Ariane Marchis-Mouren and Andrew Jones, CEO Succession and Representation of Women: Progress, Barriers, Opportunities, The Conference Board/ESGAUGE, May 28, 2025. The study does identify a pattern of shorter tenures for female CEOs, but there is no indication that it is related to activist pressure: from 2018 to 2024, the average tenure of women CEOs at Russell 3000 companies ranged from 3.9 to 6.8 years, compared to 6.9 to 9.2 years for all CEOs. Even in 2021, when women’s tenure peaked at 6.8 years, it remained well below the overall average of 9.2 years. By 2024, the gap had widened again, with women departing after just 3.9 years compared to 7 years for all CEOs. (go back)

34 Bill B. Francis, Iftekhar Hasan, Yinjie (Victor) Shen, and Qiang Wu, Do Activist Hedge Funds Target Female CEOs? The Role of CEO Gender in Hedge Fund Activism, Journal of Financial Economics 141, no. 1 (July 2021): 372–393. (go back)

35 Vishal Gupta, Sandra Mortal, and Daniel B. Turban, Do Women CEOs Face Greater Shareholder Activism Compared to Male CEOs? A Role Congruity Perspective, Harvard Law School Forum on Corporate Governance, November 7, 2017. (go back)

36 The hypothesis was first investigated in the context of the legal profession: Julie S. Ashby, Michelle K. Ryan, and S. Alexander Haslam, Legal Work and the Glass Cliff: Evidence That Women Are Preferentially Selected to Lead Problematic Cases, William & Mary Journal of Race, Gender, and Social Justice 13, no. 3 (2007). (go back)

37 Scott C. Jackson, Kristina M. Rennekamp, and Blake A. Steenhoven, CEO Gender and Responses to Shareholder Activism, Contemporary Accounting Research 41, no. 3, June 11, 2024. Also see Sarah Magnus-Sharpe, How Gender Biases Shape Investor Response to Shareholder Activism, Cornell Chronicle, October 10, 2024. (go back)

38 Vishal Gupta, Sandra Mortal, and Daniel B. Turban, You’re Fired! Gender Disparities in CEO Dismissal, Journal of Management 46, no. 4 (April 2020). (go back)

39 Clarisa Diaz and Alice Truong, How Starboard Value Has Shaken Up Corporate America, Quartz, October 16, 2023. (go back)

40 Shiri Habib-Valdhorn, Starboard Sells Off Mellanox Stake at Huge Profit, Globes, March 13, 2019. (go back)

41 Svea Herbst-Bayliss, Box Shareholders Re-Elect Company Directors; Starboard Fails to Win Any Seats, Reuters, September 9, 2021. (go back)

42 Daniel E. Wolf, Lessons From Huntsman Proxy Fight Victory Over Starboard, Harvard Law School Forum on Corporate Governance, May 1, 2022. (go back)

43 Antoine Gara, Carl Icahn Cashes Out Stake in Occidental 2 Years After Activist Battle, Financial Times, March 7, 2022. (go back)

44 Southwest Gas Announces Settlement with Carl Icahn, press release, May 6, 2022. (go back)

45 Lauren Hirsch, Icahn’s Loses Clash with McDonald’s Over Pig Welfare, New York Times, May 26, 2022. (go back)

46 Dan Primack, Dorsey Departure Another Win for Elliott Management, Axios, November 30, 2021. (go back)

47 eBay Inc. Announces Changes to Its Board of Directors, press release, September 10, 2020. (go back)

48 Svea Herbst-Bayliss and David French, Elliott wins two seats, Phillips 66 retains two seats in hotly contested board fight, Reuters, May 21, 2025. (go back)

49 Land & Buildings Calls on Aimco to Immediately Pursue a Full Company Sale Process and Highlights Significant Upside to Current Share Price, Business Wire, January 14, 2025. (go back)

50 Thomas Franck, Bed Bath & Beyond Settles with Activists, Considering Selling Buy Buy Baby, Other Stores, CNBC.com, May 29, 2019; Kohl’s and Investor Group Reach Agreement, press release, April 14, 2021. (go back)

51 Katherine Hamilton, Activist Ancora Ends Campaign After US Steel Merger Process, Morningstar, April 9, 2025. (go back)

52 Laurence Darmiento, Guess Founder, Accused Repeatedly of Sexual Misconduct, Holds on to Board Seat in Contentious Vote, Los Angeles Times, April 22, 2022. (go back)

53 Svea Herbst-Bayliss, Activist Blackwells Settles with Colony, Creates Venture to Buy Stock, Reuters, March 20, 2020. (go back)

54 Blackwells Capital Opposes Monmouth Sale to Equity Commonwealth, GlobeNewswire, August 5, 2021. (go back)

55 Kraft Heinz and Church & Dwight Are Latest Companies to Announce Plastic Reduction Goals Following Investor Engagement, As You Sow, press release, April 26, 2023. (go back)

56 Sajjel Kishan, Main Street’s Most Prolific Corporate Agitator Finds a New Battlefield in ESG, Bloomberg, May 25, 2022. (go back)

57 Notice of Exempt Solicitation, National Legal and Policy Center, February 15, 2024. (go back)

58 Notice of Exempt Solicitation, Bowyer Research, May 13, 2025. (go back)

59 Notice of Exempt Solicitation, Bowyer Research. (go back)

60 Majority Action’s New Report Shows, What’s Blocking Our Path to Sustainability?, Medium, February 7, 2025. (go back)

61 Exempt Solicitation, Majority Action LLC, April 22, 2022. (go back)

62 NY Common Retirement Fund Announces New Measures to Protect State Pension Fund from Climate Risk and Invest in Climate Solutions, Office of the New York State Comptroller Thomas P. DiNapoli, press release, February 14, 2024. (go back)

63 DiNapoli: NYS Pension Fund Commits an Additional $2.4 Billion Through Sustainable Investment Program, Office of the New York State Comptroller Thomas P. DiNapoli, press release, April 21, 2025. (go back)

64 Notice of Exempt Solicitation, Mercy Investment Services, Inc., April 16, 2025. (go back)

65 SOC Investment Group Urges Activision Blizzard Shareholders to Vote Against the Re-Election of Six Directors, SOC Investment Group, shareholder letter, May 27, 2022. (go back)

66 69.9% of Costco Shareholders Support Landmark Green Century Proposal on Climate Change, Ceres, press release, January 27, 2022. (go back)

67 11.6% of Independent Tyson Shareholders Support Green Century Deforestation Proposal, Green Century Funds, press release, February 14, 2024. (go back)

68 2025 Shareholder Season Highlights, Green Century Funds, 2025. (go back)

69 For Equal Pay Day, Racial and Gender Pay Scorecard Ranks How Largest US Companies Stack Up, Arjuna Capital, press release, March 11, 2024. (go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.